Art Index - Your Opportunity to Enter the Art World as an Investment

As many of you already might have noticed, we have an Estonian art index on our website, showcasing the growth of Estonian auction galleries in the last 20 years.

The volume of Estonian auction galleries has been constantly increasing over the past few decades, with the biggest increase occurring during the recent social crises. The Art Index provides an adequate overview of what is happening in the Estonian classical art market, which works and artists are the most valued in public sales, how the price of art has risen over time, and how the volume of auction works has changed over time.

Figure - Historical Price Performance on Kanvas.ai

The Estonian art index has been created based on information from the public auctions of Estonia's largest art galleries over the past 20 years, including HAUS gallery, Vaal gallery, Allee gallery, E-art salon, and Vernissage gallery. It is free of charge and provides a sense of security to those who want to invest in art, but feel insecure in the art world.

One of the goals of the Art Index is to be a tool for people who want to invest in art which is a big asset class. The index can be compared to a stock index or a real estate index, as it shows how the art market is constantly changing, how the prices of works of art have changed over time, what is the value of the works of a particular artist at the current time, and what is the volume of the art market.

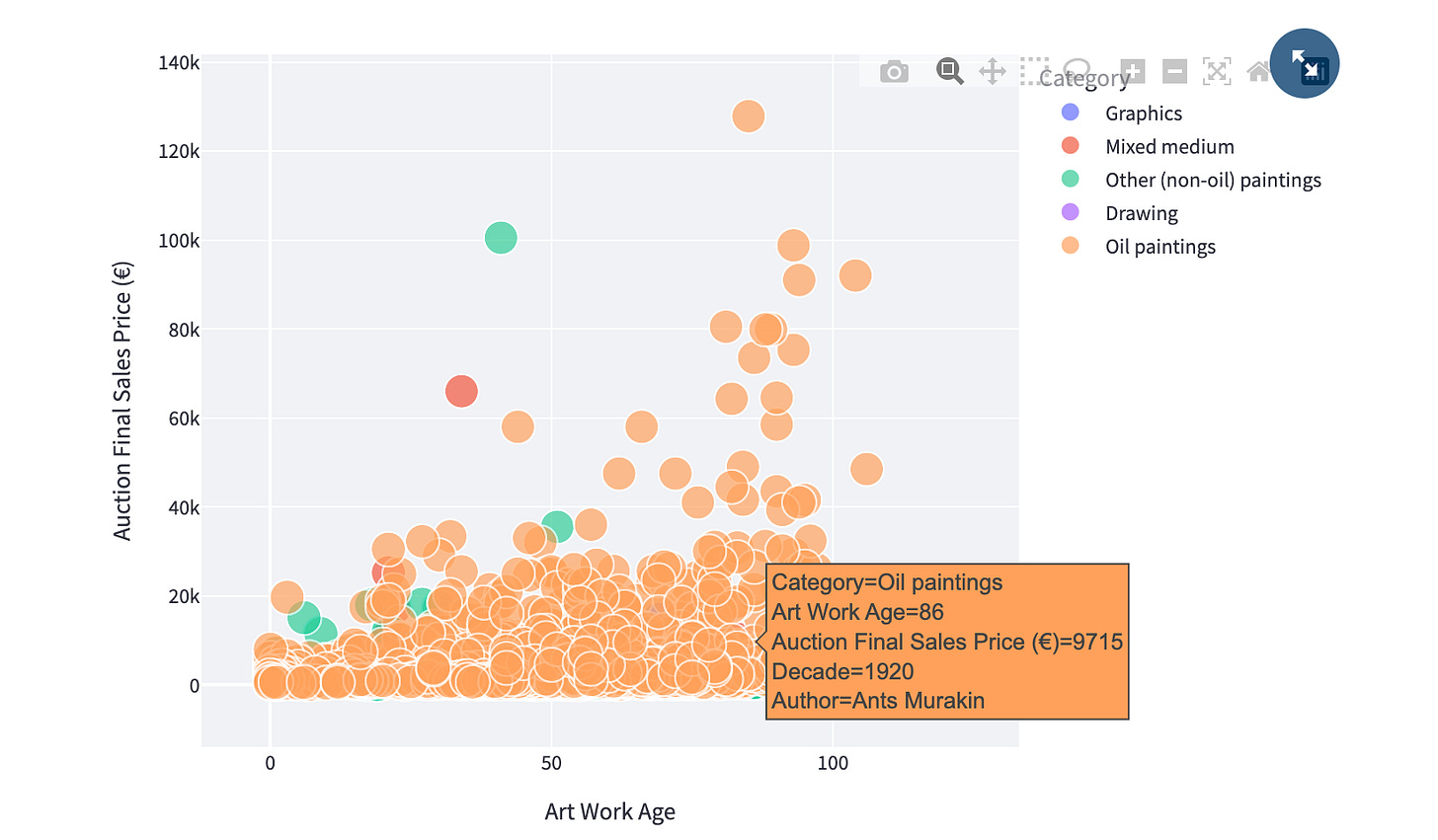

Figure - Art Sales by Category and Artist on Kanvas.ai

In the near future, we are planning to launch an European index and a dedicated index for NFT art as well, which would give buyers a sense of security that they are really buying a quality piece that has value on the secondary market. Initially, we’ll start collecting NTF art information from the sales of NFTs created on the Tezos’ blockchain which take place through the Kanvas.ai environment.

Did you know Kanvas.ai’s NFT Market has finally been launched?

At Kanvas.ai, we are also working to ensure that contemporary art, young art, and young artists also reach the art index. Our idea is for the art index to be self-complementary and become a tool for all active galleries who want to add their sales to the database. In this case, young artists would become more visible.

We highly recommend considering investments in young artists as it may entail greater risk; however, it also presents the potential for higher returns.

It is also worth noting that art is not only a monetary investment, but it also holds significant sentimental value, rendering it a complex and fascinating market.

It's important to note that investing in art, like any other asset class, has its downsides. One of the main drawbacks is the high cost of entry, making it difficult for many people to invest in. Additionally, art is not a liquid asset, meaning that it can be challenging to sell quickly if needed. It's also essential to consider art as a long-term investment.

To address these issues, Kanvas.ai is exploring Fractional Investment, a concept that allows investors to purchase a fraction of an artwork, making art investment accessible to a wider range of people.

Our team at Kanvas.ai believes that Fractional Investment is the future of art investing, and they're currently working on implementing this approach in their platform. This would allow anyone to invest in art, regardless of their budget, and it could potentially democratise the art market.

We are opening our funding round on Fundwise!

We hope that our Estonian art index will be of interest to art lovers, especially as the auction season in Estonia starts soon.

Stay tuned for more updates on our progress and the future of the art index!